Real Estate in El Salvador: A Guide for Foreigners

El Salvador Real Estate: El Salvador has emerged as a promising destination for expatriates, retirees, and investors looking to buy or rent property in Central America. With its scenic beaches, affordable cost of living, and growing economy, the country offers numerous real estate opportunities. Whether you are considering renting a home for short-term stays or purchasing property for long-term investment, understanding the legal process, costs, and market conditions is essential.

Renting Property in El Salvador

Renting is an ideal option for those who want to explore the country before committing to a property purchase. El Salvador offers a range of rental options, from beachfront apartments and modern city condos to houses in gated communities.

Finding a Rental Property

Rental properties in El Salvador can be found through real estate agencies, online platforms, and social media groups. Websites such as Encuentra24, OLX El Salvador, and local real estate agency websites list available properties. Networking within expatriate communities can also provide leads on rentals.

Rental Agreements and Requirements

Lease agreements in El Salvador typically last for six months to one year, though shorter or longer terms may be negotiable. Rent is usually paid monthly, and landlords often require a security deposit equal to one or two months’ rent. Some landlords may ask for a reference or proof of financial stability.

A written lease agreement should specify rental terms, payment schedules, maintenance responsibilities, and termination conditions. Reviewing the contract with a lawyer ensures clarity and compliance with Salvadoran rental laws.

Average Rental Prices in El Salvador

Rental prices vary based on location and property type. Below are approximate monthly rental costs for one-bedroom and three-bedroom apartments in major cities.

San Salvador: $400 – $1,200 for a one-bedroom, $900 – $2,500 for a three-bedroom

Santa Tecla: $300 – $900 for a one-bedroom, $800 – $2,000 for a three-bedroom

La Libertad (beachfront): $500 – $1,500 for a one-bedroom, $1,200 – $3,500 for a three-bedroom

San Miguel: $300 – $800 for a one-bedroom, $700 – $1,800 for a three-bedroom

Buying Property in El Salvador as a Foreigner

Foreigners can legally purchase property in El Salvador with very few restrictions. The country has strong property ownership rights, and the buying process is relatively straightforward.

Legal Requirements for Foreign Buyers

Foreigners have the same property ownership rights as Salvadoran citizens, except for rural land intended for agricultural use, which is restricted to Salvadoran nationals. To buy property, foreigners must have a valid passport and register the transaction with the Centro Nacional de Registros (CNR), the national property registry.

Steps to Buying Property in El Salvador

Finding the right property involves researching different locations, visiting properties, and working with a reputable real estate agent. Popular locations include San Salvador for urban living, La Libertad for beachfront properties, and Santa Tecla for a mix of modern amenities and suburban lifestyle.

However, due diligence is crucial before making an offer. A notary public verifies the property’s legal status, ensuring there are no outstanding debts, ownership disputes, or title issues. Buyers should request a copy of the property title and confirm the property’s tax payment history.

Once the property is cleared, a purchase agreement is signed, and a deposit, usually 10 percent of the purchase price, is paid. Additionally, the final contract is signed before a notary public, and the buyer pays the remaining balance. The property is then registered in the national property registry.

Costs of Buying Property in El Salvador

Beyond the purchase price, buyers should account for additional costs.

Transfer tax: 3 percent of the property value for properties over $28,000

Notary and legal fees: 1 to 3 percent of the purchase price

Registration fees: 0.5 to 1 percent of the property value

Real estate agent commission: 3 to 5 percent, typically paid by the seller

Property tax: Varies based on property value, generally low compared to other countries

Mortgage Availability for Foreigners

Equally important, foreigners can apply for mortgages in El Salvador, but local banks may require proof of Salvadoran residency and a local income source. Interest rates typically range from 6 to 10 percent annually. Many foreign buyers prefer cash transactions to avoid the complexities of financing.

Best Cities for Real Estate Investment in El Salvador

San Salvador is the country’s economic and cultural center, offering strong rental demand and a high appreciation rate in residential and commercial properties. La Libertad is known for its surfing beaches and tourism-driven rental market, making it a hotspot for vacation rentals. Santa Tecla provides a suburban atmosphere with modern housing developments and easy access to the capital city. San Miguel is a growing commercial hub in eastern El Salvador, with lower property prices and investment opportunities.

Key Considerations for Foreign Buyers

Before purchasing property, foreigners should research legal requirements, tax obligations, and ownership structures. Working with a licensed real estate agent and a notary public ensures a secure transaction. Buyers should also consider long-term costs, including property maintenance, security, and potential rental income if leasing the property.

Frequently Asked Questions

Can foreigners buy land in El Salvador?

Yes, foreigners can buy land in El Salvador, except for rural land designated for agricultural use, which is restricted to Salvadoran nationals.

Can foreigners rent out property in El Salvador?

Yes, foreign property owners can rent out their properties. Rental income is subject to Salvadoran tax laws, and landlords must report earnings to the tax authorities.

What is the minimum investment required for property in El Salvador?

Property prices vary, but entry-level apartments in major cities start at around $50,000, while beachfront homes and luxury properties can exceed $250,000.

Do I need to be in El Salvador to buy property?

No, foreign buyers can purchase property remotely by granting power of attorney to a legal representative in El Salvador.

Does buying property in El Salvador grant residency?

No, property ownership does not automatically grant residency. However, investing in real estate worth at least $200,000 may support an Investor Visa application.

Are there risks in buying property in El Salvador?

Yes, potential risks include title fraud, unpaid property taxes, and land disputes. Hiring a lawyer and conducting thorough due diligence can help minimize risks.

Conclusion

El Salvador offers strong real estate investment opportunities for foreigners, with relatively few restrictions on property ownership. While the process is generally straightforward, understanding the legal framework, financing options, and market trends is crucial for making an informed decision. Working with qualified professionals ensures a smooth transaction and a secure investment in El Salvador’s growing real estate market.

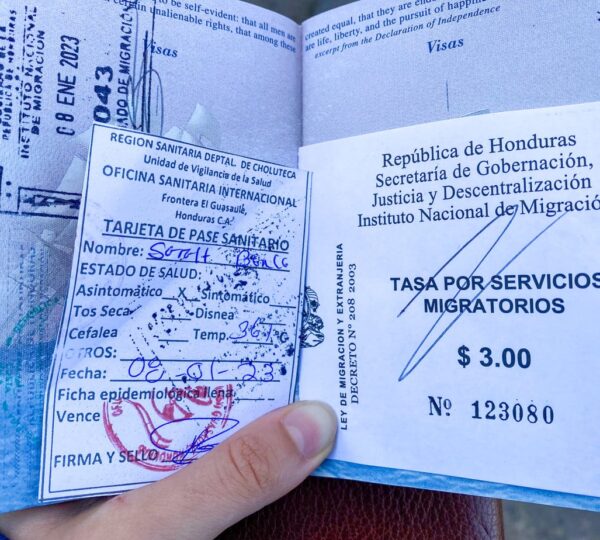

Meet An Expert

Meet with an expert today during our open office hours video calls. You will be able to ask any question you might have regarding visas, renting and buying property or just practical advice on moving, while in a group setting. It is 100% free and you can attend on your own schedule.

Recent Posts

How to Buy a Business in Spain: A Complete Step-by-Step Guide

Comprehensive Step-by-Step Guide to Obtaining Your Visa In Mexico

All Categories

- Argentina

- Australia

- Austria

- Bahamas

- Bali

- Belize

- Brazil

- Chile

- Colombia

- Costa Rica

- Czech Republic

- Denmark

- Dominican Republic

- Ecuador

- El Salvador

- Fiji

- France

- Germany

- Greece

- Hungary

- India

- Ireland

- Jamaica

- Japan

- Malaysia

- Mexico

- Netherlands

- New Zealand

- Norway

- Panama

- Peru

- Philippines

- Portugal

- Singapore

- South Korea

- Spain

- Sweden

- Switzerland

- Thailand

- UAE

- Uncategorized

- United Kingdom

- Uruguay

- Vietnam