Real Estate in the Philippines: A Guide for Foreigners

The Philippines has become an attractive destination for expatriates, retirees, and investors looking for affordable property in a tropical setting. With its stunning beaches, vibrant cities, and low cost of living, the country offers a variety of real estate opportunities. Whether you are considering renting or buying property, understanding the legal framework, costs, and key considerations is essential.

Renting Property in the Philippines

Renting is a practical option for foreigners who want to explore different areas before committing to a property purchase. The rental market in the Philippines offers everything from luxury condominiums in Metro Manila to beachfront homes in Palawan and Cebu.

Finding a Rental Property

Foreigners can find rental properties through real estate agents, property websites, and classified ads. Some popular websites for listings include Lamudi, Dot Property, and Property24. Networking through expatriate communities and local social media groups can also help in finding rental opportunities.

Rental Agreements and Requirements

Most lease agreements in the Philippines last for six months to one year, but longer-term rentals may be negotiable. Rent is typically paid monthly, and landlords often require a security deposit equivalent to one to three months’ rent. Some landlords may also ask for post-dated checks as a guarantee for future payments.

A written lease agreement should specify the rental terms, payment schedules, maintenance responsibilities, and termination conditions. It is advisable to have the contract reviewed by a lawyer before signing.

Average Rental Prices in the Philippines

Rental costs vary depending on the location and type of property. Below are approximate monthly rental prices for one-bedroom and three-bedroom apartments in major cities.

Metro Manila: $300 – $1,500 for a one-bedroom, $1,000 – $3,500 for a three-bedroom

Cebu City: $250 – $800 for a one-bedroom, $800 – $2,500 for a three-bedroom

Davao City: $200 – $600 for a one-bedroom, $600 – $2,000 for a three-bedroom

Boracay: $400 – $1,500 for a one-bedroom, $1,500 – $4,000 for a three-bedroom

Baguio: $200 – $700 for a one-bedroom, $700 – $2,000 for a three-bedroom

Buying Property in the Philippines as a Foreigner

Foreigners face some restrictions when purchasing property in the Philippines. While they cannot directly own land, they can own condominium units and houses under certain conditions.

Legal Requirements for Foreign Buyers

Foreigners can own condominiums, but only up to 40 percent of the total units in a condominium project. If purchasing a house, the land must be leased from a Filipino citizen or owned through a corporation where at least 60 percent of shares are held by Filipinos.

Foreigners married to a Filipino citizen can acquire land through their spouse, but in the event of divorce or separation, the property remains in the Filipino spouse’s name.

Steps to Buying Property in the Philippines

Finding the right property requires researching different locations and working with a licensed real estate agent. Some of the most popular areas for foreign buyers include Metro Manila, Cebu, Boracay, Palawan, and Tagaytay.

Due diligence is crucial before making an offer. Buyers should verify the Transfer Certificate of Title (for land purchases) or the Condominium Certificate of Title (for condo purchases) to ensure that the property has no liens or legal disputes.

Once due diligence is complete, the buyer and seller sign a Contract to Sell, and the buyer pays a reservation fee or deposit. After paying the full purchase price, the property title is transferred, and the sale is recorded with the Land Registration Authority (LRA).

Real Estate Philippines: Costs of Buying Property in the Philippines

In addition to the purchase price, buyers should budget for additional costs.

Documentary Stamp Tax: 1.5 percent of the property value

Transfer Tax: 0.5 – 0.75 percent of the property value

Registration Fee: 0.25 percent of the property value

Real Estate Agent Commission: 3 – 5 percent, typically paid by the seller

Notary and Legal Fees: 1 – 2 percent of the property value

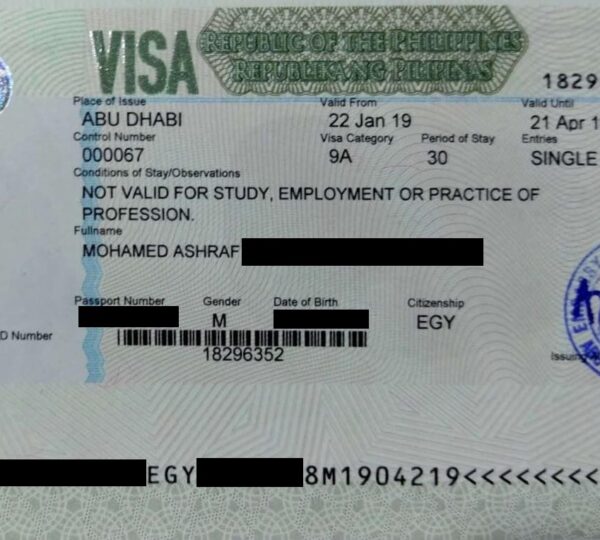

Mortgage Availability for Foreigners

Foreigners can apply for mortgages in the Philippines, but most banks require them to have a Special Resident Retiree’s Visa (SRRV) or a long-term visa. Interest rates typically range from 6 to 10 percent annually. Many foreign buyers opt for cash purchases to avoid high interest rates and complex loan requirements.

Real Estate Philippines: Best Cities for Real Estate Investment in the Philippines

Metro Manila is the country’s economic hub, offering high rental demand in areas like Makati, Bonifacio Global City (BGC), and Ortigas. Cebu City is a top investment destination with a growing economy and a strong tourism sector. Davao City offers affordable real estate and is known for its safety and economic growth. Boracay is a prime location for vacation rentals and beachfront properties. Palawan is an emerging real estate hotspot with opportunities in eco-tourism and luxury resort developments.

Real Estate Philippines: Key Considerations for Foreign Buyers

Before purchasing property, foreigners should research the legal requirements, tax obligations, and ownership structures. Working with a licensed real estate agent and a real estate lawyer can help navigate the complexities of property transactions. Buyers should also consider the long-term costs of ownership, including property maintenance, association dues, and property taxes.

Frequently Asked Questions

Can foreigners buy land in the Philippines?

No, foreigners cannot directly own land. However, they can own condominiums or lease land for up to 50 years with a one-time renewal of 25 years.

Can foreigners rent out property in the Philippines?

Yes, foreigners who own condominiums or houses can rent them out. Rental income is subject to Philippine tax laws, and landlords must report earnings to the Bureau of Internal Revenue (BIR).

What is the minimum investment required for property in the Philippines?

Entry-level condominiums start at around $50,000 – $100,000, while beachfront and luxury properties can exceed $500,000.

Do I need to be in the Philippines to buy property?

No, foreign buyers can purchase property remotely by granting power of attorney to a legal representative in the Philippines.

Does buying property in the Philippines grant residency?

No, property ownership does not automatically grant residency. However, purchasing real estate worth at least $50,000 can support an SRRV application under the Philippine Retirement Program.

Are there risks in buying property in the Philippines?

Yes, potential risks include title fraud, hidden property taxes, and disputes over land ownership. Conducting thorough due diligence and working with a real estate lawyer can help minimize these risks.

Conclusion

The Philippines offers excellent real estate opportunities for foreigners, from city condominiums to beachfront properties. While the process is relatively straightforward, legal restrictions on land ownership require careful planning. Working with licensed real estate professionals, verifying property titles, and understanding ownership regulations can ensure a smooth and secure transaction. With the right approach, investing in Philippine real estate can be a rewarding and profitable venture.

Meet An Expert

Meet with an expert today during our open office hours video calls. You will be able to ask any question you might have regarding visas, renting and buying property or just practical advice on moving, while in a group setting. It is 100% free and you can attend on your own schedule.

Recent Posts

How to Buy a Business in Spain: A Complete Step-by-Step Guide

Comprehensive Step-by-Step Guide to Obtaining Your Visa In Mexico

All Categories

- Argentina

- Australia

- Austria

- Bahamas

- Bali

- Belize

- Brazil

- Chile

- Colombia

- Costa Rica

- Czech Republic

- Denmark

- Dominican Republic

- Ecuador

- El Salvador

- Fiji

- France

- Germany

- Greece

- Hungary

- India

- Ireland

- Jamaica

- Japan

- Malaysia

- Mexico

- Netherlands

- New Zealand

- Norway

- Panama

- Peru

- Philippines

- Portugal

- Singapore

- South Korea

- Spain

- Sweden

- Switzerland

- Thailand

- UAE

- Uncategorized

- United Kingdom

- Uruguay

- Vietnam