Singapore Real Estate: A Guide to Buying or Renting Property as a Foreigner

Singapore is a global financial hub with a highly developed real estate market. Whether you’re looking to rent or buy property, it’s essential to understand the legal requirements, costs, and processes involved, especially as a foreigner. This guide provides a detailed overview of renting and buying property in Singapore.

Renting Property in Singapore

Finding a Rental Property

Foreigners can rent almost any type of residential property in Singapore, including apartments, condominiums, and landed houses.

Ways to Find Rental Properties:

- Online Listings: Websites like PropertyGuru, 99.co, and EdgeProp offer extensive rental listings.

- Real Estate Agents: Licensed agents can help navigate contracts and negotiations.

- Classifieds & Expat Groups: Platforms like Facebook Marketplace and expat forums often have rental listings.

Rental Process & Lease Agreements

- Choose a Property: Select a unit based on budget, location, and amenities.

- Submit a Letter of Intent (LOI): Express interest and reserve the unit.

- Security Deposit & Advance Rent:

- Typically one to two months’ rent as a security deposit.

- One month’s rent in advance.

- Sign the Tenancy Agreement: Ensure the lease includes:

- Rent amount and payment schedule.

- Lease duration (typically 12 – 24 months).

- Maintenance responsibilities.

- Any diplomatic clauses (if you leave early due to work relocation).

- Pay Stamp Duty: Tenants must pay stamp duty (approximately 0.4% of the total rent for the lease period).

- Move-In Inspection: Document any existing damages before moving in.

Average Rental Prices in Singapore

Rental prices vary based on location and property type:

| Location | Condominium (1–2 Bedrooms) | Landed House |

| Central (Orchard, CBD) | SGD 4,000 – SGD 8,000 | SGD 15,000+ |

| East (Katong, Bedok) | SGD 2,500 – SGD 5,000 | SGD 8,000+ |

| West (Bukit Timah) | SGD 3,000 – SGD 6,000 | SGD 10,000+ |

| North (Woodlands) | SGD 2,000 – SGD 4,000 | SGD 5,000+ |

Buying Property in Singapore as a Foreigner

Foreigners face restrictions on purchasing certain types of real estate but can buy the following:

What Can Foreigners Buy?

✔️ Condominiums & Apartments (No special approval required).

✔️ Commercial Properties (Office spaces, shops, etc.).

What Requires Government Approval?

❌ Landed Property (Houses, bungalows, etc.) – Requires government approval, which is rarely granted.

❌ HDB Flats (Public Housing) – Only available to Singapore citizens and permanent residents.

Singapore Real Estate: Steps to Buying Property in Singapore

- Determine Your Budget:

- Foreigners must pay Additional Buyer’s Stamp Duty (ABSD) of 60% on property purchases.

- Minimum property price is around SGD 1 million+ for a condominium.

- Obtain Financing (if needed):

- Foreigners can get a home loan from a Singaporean bank.

- Maximum LTV (Loan-to-Value) ratio is 75%, meaning you need at least 25% down payment.

- Hire a Real Estate Agent & Lawyer:

- An agent can help find properties and negotiate.

- A lawyer ensures legal compliance.

- Sign the Option to Purchase (OTP) Agreement:

- Pay a 1% deposit to secure the property.

- Pay an additional 4% within 14 days to exercise the option.

- Pay Stamp Duties & Fees:

- Buyer’s Stamp Duty (BSD): 1% – 6% of the property price.

- Additional Buyer’s Stamp Duty (ABSD): 60% for foreigners.

- Final Payment & Registration:

- Pay the remaining balance and complete legal paperwork.

- The property is registered under your name at the Singapore Land Authority.

Singapore Real Estate: Costs of Buying Property

| Expense | Cost for Foreigners |

| Down Payment | 25% – 40% of property price |

| Buyer’s Stamp Duty (BSD) | 1% – 6% |

| Additional Buyer’s Stamp Duty (ABSD) | 60% |

| Legal Fees | SGD 3,000 – SGD 5,000 |

| Property Tax | 4% – 20% (depending on rental or personal use) |

Singapore Real Estate: Frequently Asked Questions (FAQ)

1. Can foreigners rent any type of property in Singapore?

Yes, foreigners can rent most types of properties, including HDB flats, condominiums, and landed houses (subject to government rules for HDB rentals).

2. How much is the rental deposit in Singapore?

Typically, landlords require:

- 1-month deposit for leases under 2 years.

- 2-month deposit for leases longer than 2 years.

3. Can a foreigner buy a house in Singapore?

Foreigners can buy condominiums and commercial properties but cannot buy landed houses unless they obtain government approval (which is rare).

4. How much tax do foreigners pay when buying property in Singapore?

Foreigners pay a 60% Additional Buyer’s Stamp Duty (ABSD) on top of regular Buyer’s Stamp Duty (BSD).

5. Can I get a mortgage as a foreigner?

Yes, many Singaporean banks offer home loans to foreigners, but the maximum Loan-to-Value (LTV) ratio is 75%, meaning you need at least 25% down payment.

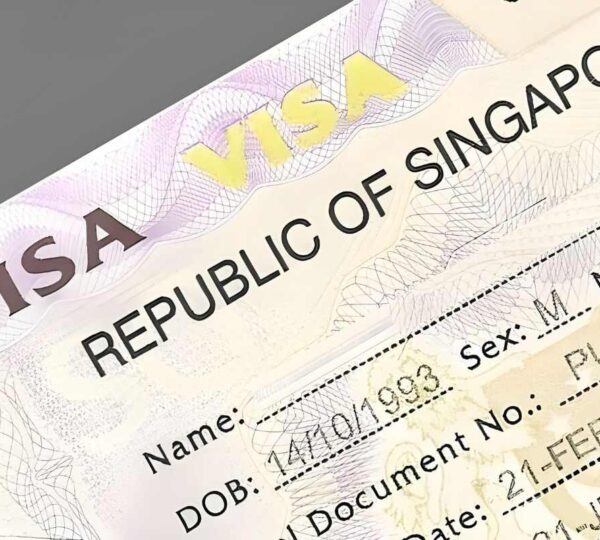

6. Can I get permanent residency by buying property in Singapore?

No. Buying property does not grant residency or a visa. Residency applications are separate and require employment, investment, or family ties.

Singapore Real Estate: Conclusion

Singapore’s real estate market is one of the most expensive in the world, with strict government regulations for foreign buyers. While renting is straightforward, buying property as a foreigner is challenging due to high taxes and restrictions on landed property. However, investing in a condominium remains a popular choice for those seeking long-term residency or rental income in Singapore.

Meet An Expert

Meet with an expert today during our open office hours video calls. You will be able to ask any question you might have regarding visas, renting and buying property or just practical advice on moving, while in a group setting. It is 100% free and you can attend on your own schedule.

Recent Posts

How to Buy a Business in Spain: A Complete Step-by-Step Guide

Comprehensive Step-by-Step Guide to Obtaining Your Visa In Mexico

All Categories

- Argentina

- Australia

- Austria

- Bahamas

- Bali

- Belize

- Brazil

- Chile

- Colombia

- Costa Rica

- Czech Republic

- Denmark

- Dominican Republic

- Ecuador

- El Salvador

- Fiji

- France

- Germany

- Greece

- Hungary

- India

- Ireland

- Jamaica

- Japan

- Malaysia

- Mexico

- Netherlands

- New Zealand

- Norway

- Panama

- Peru

- Philippines

- Portugal

- Singapore

- South Korea

- Spain

- Sweden

- Switzerland

- Thailand

- UAE

- Uncategorized

- United Kingdom

- Uruguay

- Vietnam