Spain Real Estate: A Guide to Renting or Buying Property as a Foreigner

Spain Real Estate: Spain is a top destination for expatriates, retirees, and investors due to its rich culture, sunny climate, and attractive real estate market. Whether you’re looking to rent or buy, understanding the legal and financial aspects of property transactions in Spain is essential. This guide provides a comprehensive overview of how foreigners can rent or buy property in Spain.

Renting Property in Spain

Finding a Rental Property

- Online Platforms – Websites like Idealista, Fotocasa, and Pisos.com list rental properties across Spain.

- Real Estate Agencies – Using a licensed real estate agent (Inmobiliaria) can help you find properties and negotiate contracts.

- Word of Mouth – Networking in expat communities or local social media groups can uncover hidden rental opportunities.

Spain Real Estate: Rental Agreements

- Lease Duration – Typically 12 months, but short-term rentals are available in tourist areas.

- Security Deposit – Usually 1-2 months’ rent, refundable upon lease termination.

- Utilities – Electricity, water, and internet may or may not be included in the rent; clarify this with your landlord.

- Documentation Required –

- Passport or NIE (Foreigner Identification Number).

- Proof of income (employment contract or bank statements).

- Sometimes a guarantor or additional deposit is required.

Rental Prices by Region

- Madrid & Barcelona – €1,000-€3,000 per month for a city-center apartment.

- Valencia & Seville – €700-€1,500 per month.

- Costa del Sol & Alicante – €500-€2,000 per month, depending on location and proximity to the beach.

Spain Real Estate: Buying Propertyas a Foreigner

Can Foreigners Buy Property in Spain?

Yes, foreigners can buy property in Spain with no restrictions. However, non-EU citizens should be aware of residency implications and taxation rules.

Spain Real Estate: Steps to Buying Property

1. Obtain a Foreigner Identification Number (NIE)

- This is required for any property purchase. Apply at a Spanish police station or consulate.

2. Open a Spanish Bank Account

- Needed for paying fees, taxes, and mortgage transactions.

3. Work with a Real Estate Agent and Lawyer

- A real estate agent helps find properties and negotiate deals.

- A lawyer ensures legal due diligence, verifies property ownership, and checks for any debts.

4. Conduct a Property Check

- Verify the Nota Simple (property registry extract) to confirm ownership and debt status.

- Ensure the property complies with local zoning laws.

5. Sign a Preliminary Contract (Contrato de Arras)

- This reservation agreement typically requires a deposit of 10% of the purchase price.

6. Finalize the Sale with a Notary

- Sign the Escritura de Compraventa (Deed of Sale) in front of a Spanish notary.

- Pay the balance of the purchase price.

7. Pay Taxes and Fees

- Property Transfer Tax (ITP) – 6-10% for resale properties.

- VAT (IVA) & Stamp Duty – 10-11.5% for new properties.

- Notary & Registration Fees – 1-2% of the purchase price.

- Legal Fees – 1-3% of the property value.

Financing a Property in Spain

Can Foreigners Get a Mortgage?

Yes, many Spanish banks offer mortgages to foreigners, typically financing 60-70% of the property value.

Mortgage Interest Rates (2024 Estimate)

- Fixed Rate: 3.5% – 5%

- Variable Rate: 2% – 4%

Requirements for a Mortgage

- Valid passport and NIE.

- Proof of income and employment history.

- Bank statements and tax returns for the last two years.

Best Places to Buy Property in Spain

1. Madrid – Ideal for investors looking for rental income.

2. Barcelona – Popular among international buyers; higher property prices.

3. Valencia – More affordable, with a growing expat community.

4. Costa del Sol (Marbella, Málaga) – Best for retirees and holiday homes.

5. Alicante – Popular among European retirees for its affordability.

Frequently Asked Questions (FAQs)

1. Can buying property in Spain grant me residency?

Yes, through the Golden Visa program, a property purchase of €500,000 or more can grant you a Spanish residence permit.

2. Is it better to rent or buy in Spain?

It depends on your long-term plans. Renting is flexible, while buying offers stability and investment potential.

3. Do I need a lawyer when buying property?

Yes, a lawyer ensures that the property has no debts, legal issues, or ownership disputes.

4. What are the risks of buying property in Spain?

- Unregistered properties.

- Buying property with hidden debts.

- Real estate scams targeting foreigners.

5. What additional costs should I expect when buying property?

- Taxes and fees typically 10-15% of the property price.

- Maintenance costs and local municipal taxes.

Conclusion

Spain offers a variety of real estate opportunities for foreigners, whether you’re looking to rent, buy, or invest. By understanding the legal requirements, taxes, and financing options, you can make an informed decision that suits your needs. Working with professionals such as real estate agents, lawyers, and financial advisors can ensure a smooth property transaction.

Our Directory

Use our database to find visa facilitators, real estate agents, and recommended professionals. You will also have the ability to book a time to meet with our expats on the ground. These are individuals just like you who have gone through the immigration process and have been living in your desired country or city.

Recent Posts

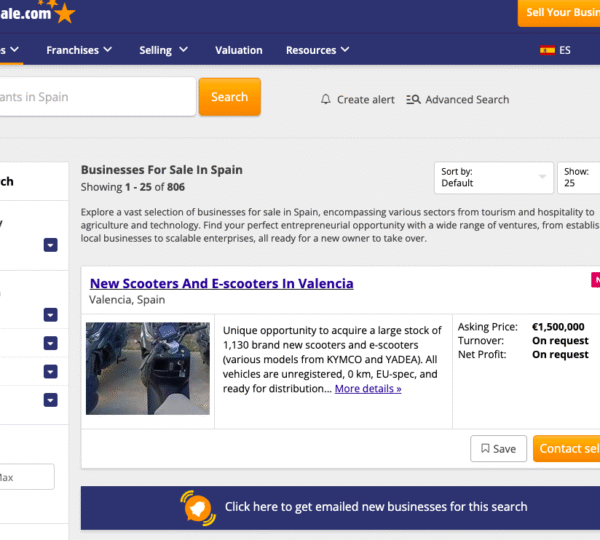

How to Buy a Business in Spain: A Complete Step-by-Step Guide

Comprehensive Step-by-Step Guide to Obtaining Your Visa In Mexico

All Categories

- Argentina

- Australia

- Austria

- Bahamas

- Bali

- Belize

- Brazil

- Chile

- Colombia

- Costa Rica

- Czech Republic

- Denmark

- Dominican Republic

- Ecuador

- El Salvador

- Fiji

- France

- Germany

- Greece

- Hungary

- India

- Ireland

- Jamaica

- Japan

- Malaysia

- Mexico

- Netherlands

- New Zealand

- Norway

- Panama

- Peru

- Philippines

- Portugal

- Singapore

- South Korea

- Spain

- Sweden

- Switzerland

- Thailand

- UAE

- Uncategorized

- United Kingdom

- Uruguay

- Vietnam